After a record show in February and March, UPI (Unified Payments Interface) transactions had taken a bump as the Covid-19 second wave swept India. And now that its effect are slowly ebbing, the UPI-backed digital transactions have made a strong comeback. They have recorded their highest transactions, both in volume and value, in June, according to data released by NPCI (National Payments Corporation of India).

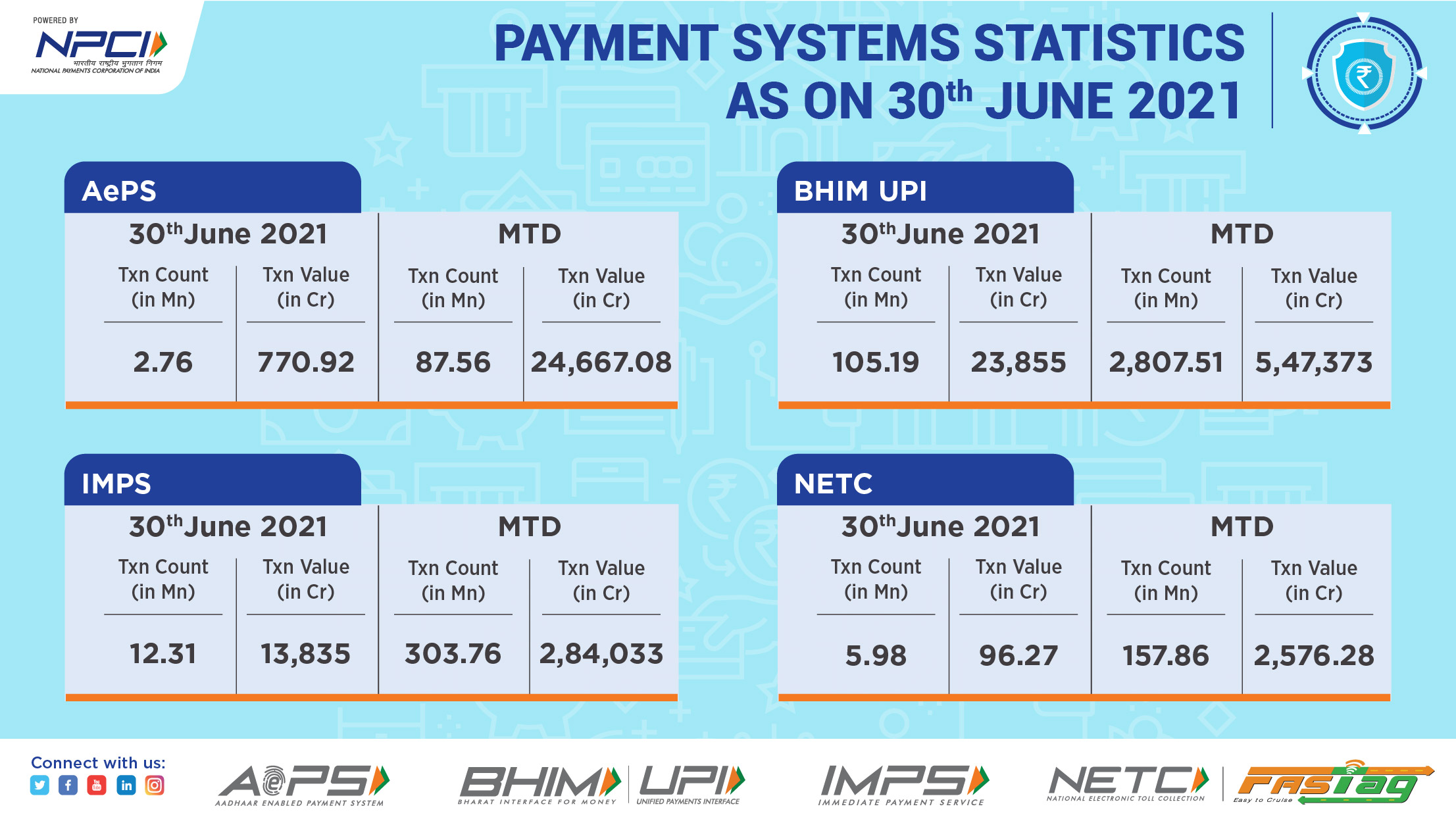

The digital payments platform logged 2.8 billion or 280 crore transactions worth Rs 5,47,373 crore in June.

In terms of volume, this is a 10.6% rise. And in volume, it saw a surge of 11.56% in comparison to its May numbers that were pegged at 2.53 billion transactions worth Rs 4,90,638 crore.

UPI's previous highest figure was in March which was 2.73 billion worth Rs 5,04,886.44 crore.

- Flipkart hives off PhonePe, chips in with $700 million investment - Here's why

- More than 6.1 billion people will use digital payments by 2023

- Google Pay to support UPI payments over NFC in India - Just tap and pay

Hectic activity in UPI ecosystem

It may be recalled that the UPI first breached the two billion mark back in October 2020.

The surge in UPI transactions have come even as the NPCI plans to take the platform overseas.

UPI is the common system that powers multiple bank accounts into a mobile application, merging several banking features, seamless fund routing and merchant payments. It also caters to the "Peer to Peer" collect request.

NPCI manages the UPI, and is the umbrella organisation for operating retail payments and settlement systems in India.

The Reserve Bank of India (RBI) is also working on on plans to allow private players to provide a platform like the NPCI, and reduce its monopoly.

UPI is seeing tight competition among three main players — PhonePe, Google Pay, and Paytm. PhonePe, backed by Flipkart, is the market leader, overtaking Google Pay.

from TechRadar - All the latest technology news https://ift.tt/3dANzap

0 Comments